Not known Facts About Fredericksburg bankruptcy attorney

There’s some protocol to comply with during the months in advance of submitting for bankruptcy. Failing to stick to these instructions could undermine your endeavours. Right here’s what never to do in advance of bankruptcy, no matter whether it’s Chapter seven or A different style.

Just about every bankruptcy case differs. Only it is possible to choose which type of bankruptcy is greatest for your personal situation. Learn more by reading through Chapter seven vs.

Declaring bankruptcy really should only be considered A final vacation resort. Depending upon the type of bankruptcy you file, you may be necessary to market your property, meet up with with (and respond to questions from) all of the men and women that you just owe dollars, Reside less than a court-ordered budget for up to five many years, suffer a major hit in your credit rating, and locate it tricky to get a home, a car, or a personal personal loan for approximately 10 years.

Chapter eleven. This is usually utilized to reorganize a business. Similar to Chapter thirteen, the small business will Are living underneath a program for operating the corporate even though spending off their financial debt.

Once you’ve labeled the type of credit card debt you owe, you’ll have to have to determine whether the debts you've are secured debts or unsecured debts. Secured debts are debts which have been backed by some type of collateral. Home loans and motor vehicle loans are two of the most common examples of secured debts.

While no-one wishes to fork out attorney service fees, it may be really worth executing When your scenario is sophisticated. And keep in mind, Expense isn’t The one thing to contemplate when using the services of a lawyer. Most bankruptcy attorneys give a free of charge First session.

The law is very restrictive on discharging cash owed for revenue taxes and college student financial loans. The United States Bankruptcy Code lists 19 groups of debts that aren't dischargeable. For most occasions, filers receive a discharge roughly two months after the creditors meet up with.

Moreover, debtors are not able to have had a Chapter 7 discharge within the former 8 a long time or possibly a Chapter 13 discharge in the past six many years. These time restrictions reduce abuse website link in the bankruptcy process.

Provides Solomon, “Men and women use several Incorrect tricks to cover their assets just before filing for bankruptcy, but they do not know every one of these tricks is usually caught quickly because of the trustee.”

Chapter 13 bankruptcy, normally referred to as reorganization bankruptcy, permits debtors to maintain their property even though repaying debts above three to five years by way of a court docket-authorised repayment plan.

I very propose making use of Upsolve for anyone who's financially unstable and needs a method away from all of Check This Out their debt and they do not experience like they might get forward.

Chapter seven bankruptcy will not shield co-signers from remaining pursued by creditors. If a debtor’s bank loan or debt contains a co-signer, more the creditor can even now look for repayment with the co-signer even after the debtor’s obligation is discharged. Also, filing for Chapter seven read this bankruptcy is a make a difference of community document.

Although product sales enhanced some during the peak on the COVID-19 pandemic, when individuals cooked and ate at your home a lot more, Tupperware observed an Total continual decline over time.

Start off by filling out a his explanation prolonged series of kinds that element documents of assets, liabilities, cash flow, fees, and Total economical standing, in addition to any current contracts or leases from the debtor’s identify.

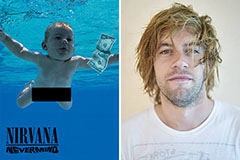

Spencer Elden Then & Now!

Spencer Elden Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!